Piggy Banking is a money-saving method which focuses on not only visibility over one’s cash flow but also planning for future needs.

“Piggy Banking was too hard”

The problem with the method was that in its original incarnation it requires people to manage and use purpose-specific bank accounts, i.e.:

- Treats: buying a non-essential treat;

- Bills: paying for rent or utilities;

- Travel: for public transport;

- Personal Care: beauty items, etc;

- Entertainment: going to the cinema, etc;

- Gifts: “Oh, I can’t be bothered”.

While the method itself does indeed work and has a good psychological foundation1, for most people it’s just too hard.

The Job

“Louie simplified a complex problem through Psychology and Design. Would hire him again.”

Andrea Prieto

Andrea Prieto

Lead Designer at OnTrees

I was hired to understand what didn’t work with Piggy Banking and other money-saving methods, incorporating what did work into a mobile app that could be used by everyone.

I had a great time working with Andrea—Lead Designer at OnTrees, a cashflow and budgeting service2.

The project lasted for 4 months, during that time I was given the freedom to mature the concept using tools and process of my choice, and together with Andrea we discussed what to do next, conducted stakeholder meetings, user research and more.

Process and Tools

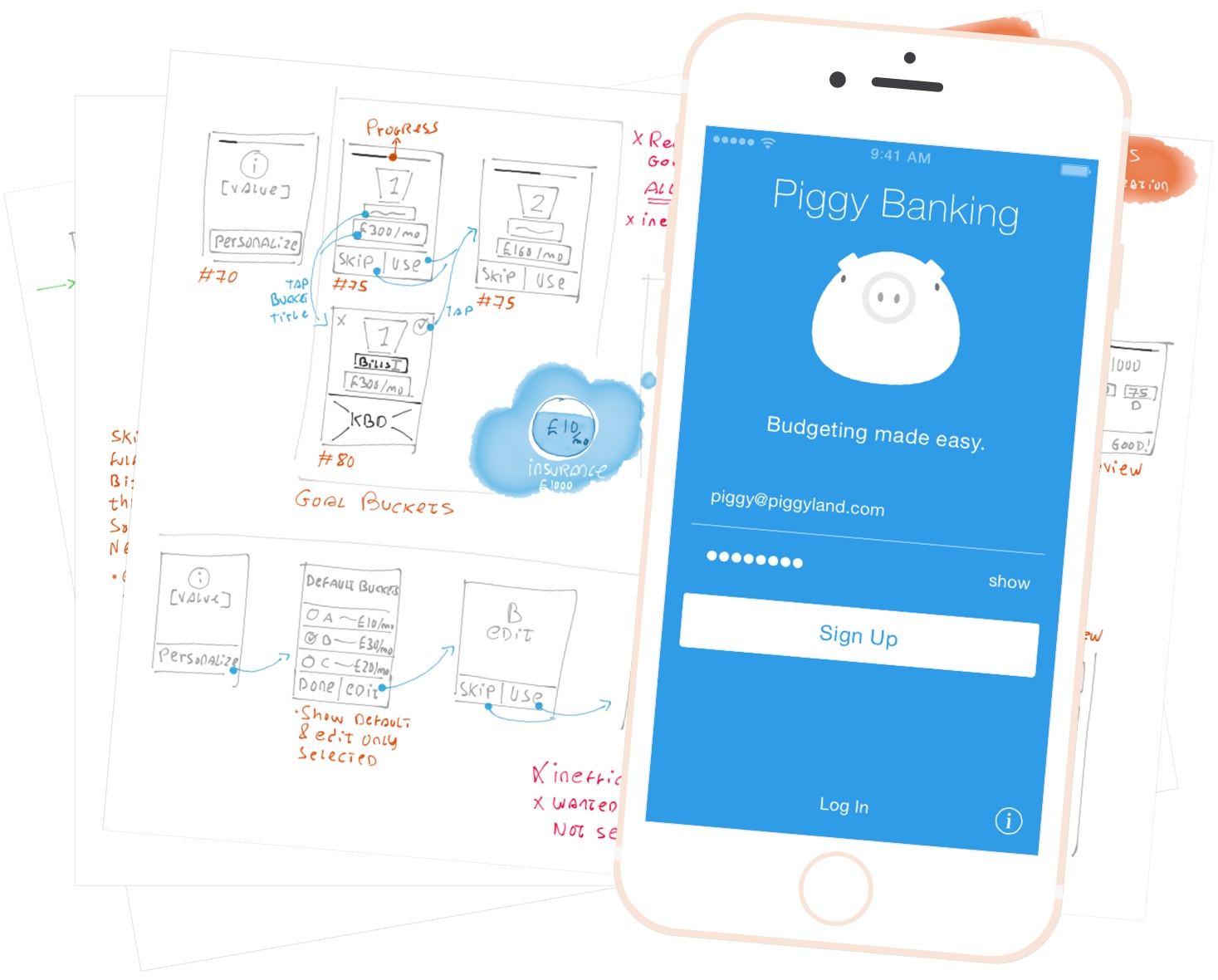

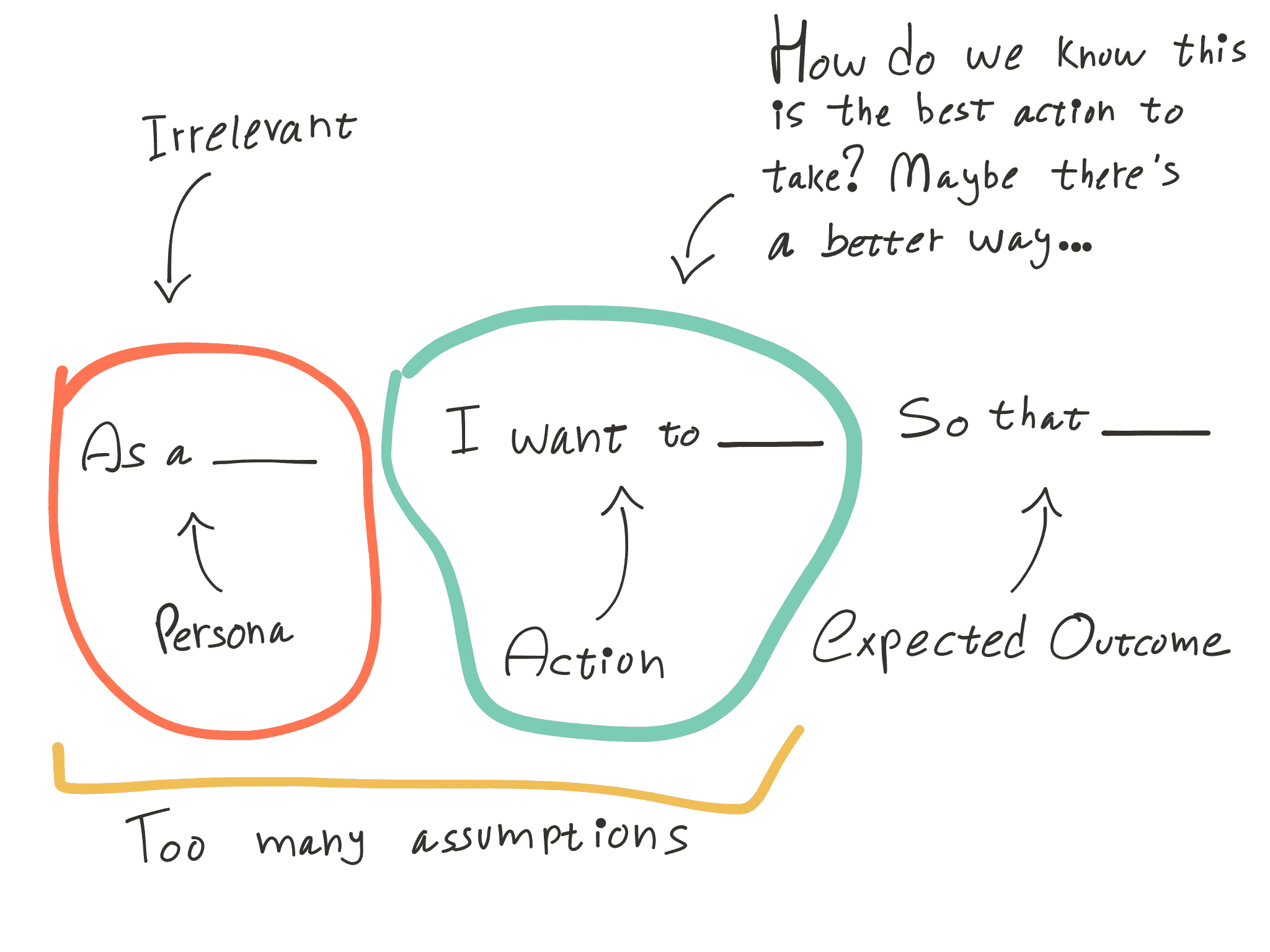

(Assumptions and disconnect between the persona and action; Alan Klement; medium.com)

The process I followed started with competitor research and analyzing common strategies, technologies3 in other money-saving apps4.

Then, I defined the product and the Jobs5 it would do, this helps us focus on the essential features.

Equally important was defining what Piggy Banking wouldn’t do (i.e. no Transaction Automation or Advanced Reporting).

Piggy Banking’s main Job is to Save Money and there are two main reasons people hire Piggy Banking:

- Get out of debt

- Build disposable income

I also defined the strategy in terms of Acquisition, Activation, Retention, Revenue and Referral (AARRR), possible partnerships, strengths, weaknesses, KPIs and more.

To help define our demographics and understand who and how many potential customers we might have (plus ARPU), I researched and validated through user interviews the Motivations, Ability and Triggers for use of Piggy Banking (Fogg’s Behavior Model6).

In the end we chose to focus on Professionals—Pre/Post-Family—instead of Students—the former is more likely to need and use Piggy Banking.

Key findings

“Even though it’s very cute, I don’t think it’s child-like”

One of our doubts was wether the character we’d chosen—a Piggy—would put off our slightly older demographic. We were pleasantly surprised as every single person we interviewed found it to be very relatable and not at all detrimental to trust.

Other findings

- Most people use Credit Cards with remorse;

- Most people try but don’t have time to keep track of their finances;

- Most people used their phone very frequently and had one or more utility apps beyond messaging.

“The biggest mistake we made was thinking onboarding needed to end quick”

Turns out that in some cases, onboarding is 80% of the app.

Commonly, my task as a UX Designer is to optimize for task completion: get users to signup, email, hail a cab in the shortest amount of time.

In Piggy Banking we decided to spare the user of whatever processes happened in the background, as a result, users did not have enough understanding of the app to envision how it would work on a daily basis or even how to set it up properly.

Given that post-onboarding, the app mostly acts as a dashboard, increasing friction and detail to the onboarding process actually helped users.

End Result

In the end, I delivered sketches, strategy documentation, session videos and reports, an experience map of how the app would handle daily scenarios in the long-run, visual mockups and prototype.

Even though the implementation is on hold for now, the learnings from this project were used in other products within the company.

If you’re looking for this kind of product design work, just get in touch at the bottom of the page!

-

Mainly accounting for Present Bias — we’re bad at planning and thinking ahead. ↩

-

OnTrees is part of a larger and well-known company in the UK called MoneySavingExpert whose focus is on helping people save money throughs carefully and frequently updated content. ↩

-

One of those technologies is Yodlee which provides automatic bank statement import and categorization. ↩

-

Levelmoney, Mint, Tink, YouNeedABudget, more ↩

-

Using the Jobs-to-be-done framework, if you’re unfamiliar you can read more about it at the Intercom blog or watch a 5 minute intro by Clayton Christensen, professor at Harvard Business School ↩

-

Fogg’s Behavior Model: “What Causes Behavior Change?” ↩